Last Jan. 20, SK Telecom CS T1 published that they’ve granted Lee “Faker” Sang-hyeok a stock option. If Faker exercises his stock option, he will become a shareholder of T1 with 5.66% of the shares. In this case, he can participate in T1’s business as a shareholder and get dividend payments.

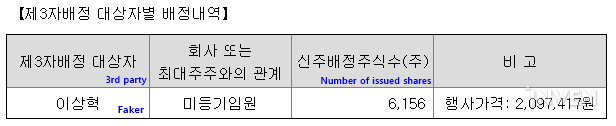

A resolution was passed last Jan. 16, which launched a 3rd party allocated rights issue. According to the resolution, Faker can purchase 6,156 new stocks of T1 at 2,097,419 KRW (≒1,700 USD) per stock. The stock option privilege can be exercised after a certain amount of time.

Ahead of this, T1 had granted a ‘part owner’ authority to Faker as they re-signed him in 2020. It was told that Faker had been given a share of T1, but according to the audit report of April 2022, Faker did not have a share up to now. This audit report represents T1’s business for 2021. The audit report for 2022 hasn’t yet been published.

If Faker exercises his stock option fully, he will own 5.66% of T1’s shares. Before the rights issue, T1 had 102,601 shares. If Faker exercises his stock option, it will become 108,757 shares. To purchase the total 6,156 shares, he will need about 12.9B KRW (≒10.5M USD).

An authority from T1 said, “Faker is a player that has been living the history of T1 since 2013. With his three-year contract and this stock option, T1 and Faker’s short and long-term goals have coincided. I believe it will contribute to both parties’ constructive growth and development as well as improve the value of the corporation.”

Sort by:

Comments :0